The Probability of Default (PoD) of a company is the central concept behind a conventional rating. Ratings constitute a fundamental link between the markets and investors. Their importance cannot be overstated. However, traditional ratings, according to the Credit Rating Agencies themselves, are merely opinions. The process of computation of a Probability of Default of a company is not only subjective, it lacks transparency and, given the fact that it is not a strictly scientific process, it may be manipulated, leading to issues such as conflicts of interest and fraud.

The Big Three rating agencies have been providing ratings since the beginning of the 20-th century. The world was very different then. Traditional ratings have become dangerously outdated and, most importantly, not suited for a turbulent economy. As the complexity of the economy grows, conventional ratings produce questionable results. Mathematically correct but irrelevant. This has become apparent in 2007 when Credit Rating Agencies have misled investors and contributed significantly to the economy meltdown. The new rating concept introduced by Uniratings has been engineered specifically for turbulence and a fast economy dominated by shocks, bubbles and instability. Markets are not efficient. In Nature there is no such thing as equilibrium.

Conventional ratings will surely continue to be used in the foreseeable future. However, in order to provide investors with new knowledge and insights we propose a novel, objective complexity and resilience-based rating. Increasing complexity is, with all likelihood, the most evident and dramatic characteristic of the economy. It is also the hallmark of our times. Resilience is the capacity to withstand shocks and is a measurable physical quantity. A resilience-based rating is applicable to companies, stocks, portfolios, and funds, systems of companies or national economies. In our turbulent economy, which is fast, uncertain and highly interdependent, extreme and sudden events are becoming quite common. Such events will become more frequent and intense, exposing fragile businesses to apparently unrelated events originating thousands of kilometers away. This mandates that companies and investors focus not just on performance but also on resilience, building less complex, less fragile businesses. Resilience means survival and sustainability. But most importantly, our resilience-based ratings are science, not opinions.

Resistance to Shocks (RtS) is measured on a scale from 0% to 100%. Values close to 100% denote high stability and ability to absorb turbulence and shocks. Low values, on the other hand, reflect vulnerability which may affect long-term sustainability.

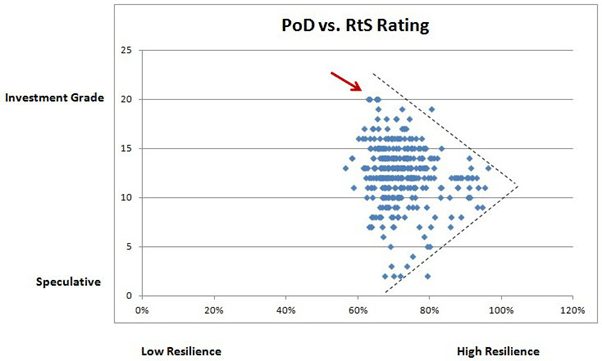

A comparison between the conventional Long-Term Probability of Default ratings and Resistance to Shocks ratings has been performed for the Top 500 companies listed on the NASDAQ, the Dow and the S&P. In order to enable the comparison, conventional PoD ratings have been transformed from the well known “AAA” format to numbers ranging from 0 to 20. The lowest rating (speculative grade) corresponds to 0 while 20 indicates a top investment grade rating. The results are reported in the graph below.

It is interesting to note that most of the highly rated companies have an RtS rating ranging from 60% to 70% while those with highest RtS values (85% to 95%) have a medium grade PoD rating with moderate risk.

Of the nearly 500 companies, 5 are Prime Grade (see red arrow), another 3 one notch less and 5 two notches less. With only one exception, all of these have an RtS rating of 70% or less. The majority of the companies have a PoD rating in the Lower and Upper Medium Grade with a spread in terms of RtS rating in the 55% to 90% range. Finally 73 companies have a rating that is below Speculative Grade. With one exception, most have an RtS rating ranging from 60% to 75-80%.

In essence, we have a triangular domain which prompts the following conclusions (NB these apply only to the three mentioned markets):

- Triple-A ratings do not correspond to companies with the highest Resistance to Shocks rating (around 65%). In fact, triple-A ratings are weak. They contain fragility.

- Companies with the highest Resistance to Shocks rating have a Lower and Upper Medium Grade rating. Here the RtS rating spread is from 55% to 90%. Hence, Lower and Upper Grade ratings point to situation of highest stability.

- Highly Speculative Grade ratings may, however, indicate situations of relative stability (around 70%, even up to 80%). In other words, there is ‘stable junk’ out there.

The main, conclusion of the study is that triple-A ratings are generally weak. This is, somewhat, not surprising. In essence, these cases correspond to situations of high performance which comes at a price: fragility. An analogy that immediately comes to mind is that of a formula one car.

Great post my Chief. From my experience in the field of complexity and resilience powered by the guidance of my mentor- Dr Jacek, I found that PoD (Probability of default) is a pseudo first order level assessment. It doesn’t even see the smoke let alone the fire.

The most interesting thing about the Power of Ontonix computing is that, it helps you see the pre-fire, the sparks (the interdependencies that matter to the fragility and stability of the system of study). This kind of knowledge informs wiser and early decisions and actions. What a way to survive and thrive through unknowns!

LikeLike