Ontonix is seeking to build strategic partnerships with global players in order to investigate systemic risks in a totally new light. The Quantitative Complexity Theory (QCT) allows us to formulate the problem from a unique large-scale, multi-disciplinary and truly systemic perspective. The focus is in the following areas:

- Systemic Collapse and its prevention

- Critical Infrastructure monitoring, protection, early warnings

- Global Risks

- Emergency Management

The approach to the above problem classes hinges on the quantification and monitoring of their dominant characteristic, their complexity. Today this can be achieved on a very large scale using our QCM engine OntoNet and supercomputers.

Systemic Collapses

Systemic collapse is a catastrophic failure of an entire system, a corporation, or network, that is triggered by an event causing severe structural instability which can impair its functioning on a large scale and for prolonged periods of time.

Ontonix analyses large and critical systems and infrastructures in order to provide a quantitative and near real time assessment and indicators of:

- Systemic complexity

- Resistance to shocks (endogenous and/or exogenous)

- Critical complexity (the level of complexity at which a given system inevitably becomes non-governable)

- Complexity drivers (a ranked list of potential problem sources)

- Complexity Map

Examples of systems we are able to monitor, analyse and determine their distance from potential systemic collapse:

- States

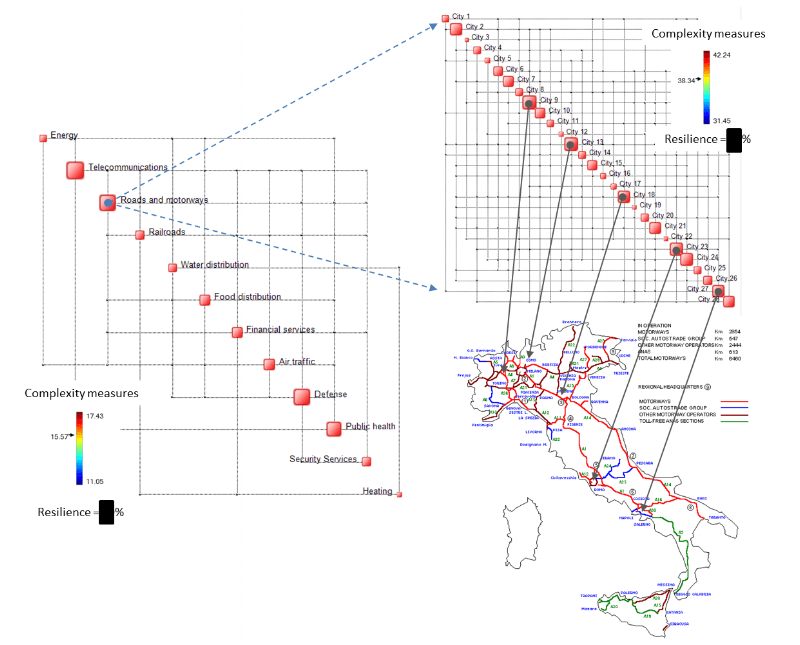

- Critical infrastructures (energy distribution, telecommunication network, traffic systems, water distribution, etc.). See example

- Large IT networks

- Economies

The uniqueness of our approach is that not only we measure and monitor the principal characteristic of these systems – their complexity – we analyze them all together, capturing their interactions in a truly integrated ‘system of systems’ perspective.

Our goal is to:

- Prevent systemic catastrophic collapses

- Guarantee structural stability of large and critical systems

- Identify pre-crisis and pre-collapse signals

- Provide assistance in Crisis and Situation Management

- Measure and Monitor Resilience

Global Risks

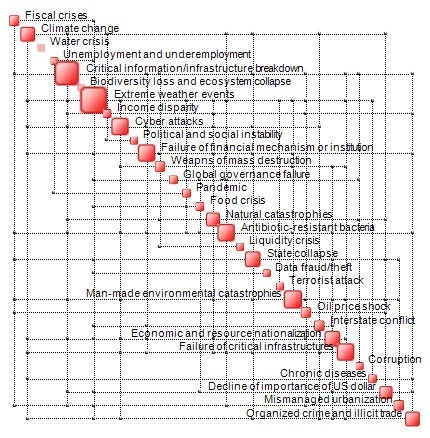

The annual WEF Global Risks Report lists many of the so-called global risks but fails to identify the most important one arising from the combination and interaction of them all – complexity.

Complexity-induced risk is a new and modern form of risks that is not visible to conventional monitoring techniques.

An example of a global risks Complexity Map is illustrated below.

According to the WEF, their Global Risks Reports analyses 50 global risks in terms of impact, likelihood and interconnections, based on a survey of over 1000 experts from industry, government and academia. In other words, their global risk maps are based on subjective views of individuals who are experts in their respective fields, who use their own established models of analysis, simulation, etc. Clearly, subjective opinions lead to subjective results and conclusions.

When things get really complex, a thousand experts can deliver a thousand opinions, all of which may seem credible and fit the real picture. The words “resilience”, “complexity”, “systemic risks”, “systems thinking” are increasingly popular. There are numerous studies and publications on these subjects. This is good. However, what these studies have in common is lack of a quantitative perspective. Complex? How complex? Resilient? How resilient? 10%, 30%? If we don’t incorporate a quantitative dimension into these analyses, which are unquestionably valuable, they will inevitably remain in the sphere of subjectivity.

Critical Infrastructure Monitoring and Protection

Critical infrastructures form the backbone of every modern nation:

- electricity generation, transmission and distribution;

- gas production, transport and distribution;

- oil and oil products production, transport and distribution;

- telecommunication;

- water supply (drinking water, waste water/sewage);

- agriculture, food production and distribution;

- heating (e.g. natural gas, fuel oil, district heating);

- public health (hospitals, ambulances);

- transportation systems (fuel supply, railway network, airports, harbours, inland shipping);

- financial services (banking, clearing);

- security services (police, military).

Each of these is a network which interacts with the the other networks. In other words, Critical Infrastructures form a large and complex system of systems as shown in the example below.

As mentioned, the above system of systems is complex. But how complex is that? Thanks to our QCM technology we can actually monitor this system in its entirety and answer the following key questions from a systemic perspective:

- How complex is the system?

- How resilient is the system?

- When, during the year, is the system most complex and most vulnerable?

- How close to its critical complexity does it function?

- Which are the elements that drive complexity?

- Which infrastructures are most resilient?

- Which infrastructures are most complex?

- Which infrastructures are most vulnerable?

- What are the most likely modes of systemic collapse?

- How to assist crisis management authorities

In order to answer these questions it is necessary to constantly monitor all of these systems and to process the resulting data on a 24/7 basis. Lack of data is today no excuse – we live in the Big Data age, don’t we? The same may be said of supercomputers which are becoming a commodity. Finally, complexity and resilience can be measured. Since 2005.

A capability of this sort is invaluable to the government of any modern state. The technology and tools to do it are already there. So is the data. The last missing piece is a credible partner. Interested?

Powerful post as usual. The world must wake up to knowledge and continuous insights into her dynamics and fragility and resilience of the dynamics to inform better decisions. We are happy at Netcad Solution Limited (and all its small units) to be connected and partnered with Ontonix to power the new Gen Blobal Risk Evaluation for actionable knowledge . Up Up We Go!

LikeLike