When talking of derivatives and other sophisticated financial products, people often say that they are complex, that they have complex dynamics. But what does that really mean? When is dynamics complex? What does complex mean? A layman’s definition of complex is difficult to grasp, to understand, to control, to forecast. While mathematically speaking things a re a bit more involved, this “definition” is essentially correct.

Complexity, however, like most things in life, is not a static or “permanent” property. As all things change constantly, the same may be said of complexity. Because nothing stays the same (remember, you cannot step twice into the same river) complexity can be studied and assessed only in a dynamic context. In the very rare occasions in which the complexity of a system remains constant we’re actually talking of how complicated that something is, not how complex. Imagine a watch movement – its properties don’t change over time, the system is essentially a one-degree-of-freedom system that is, for all practical purposes, deterministic and unable to deliver surprises. Systems which are time-invariant and deterministic can be described by structure alone – by structure me mean the topology of the dependencies of the system’s parameters as illustrated in the simple example below. The three cases below correspond to a 7-parameter system in which the number of dependencies increases from left while the number of nodes (parameters) remains unchanged.

In the case of the watch movement, as the sophistication of the mechanism increases, the external observer sees no difference – the system continues to be a deterministic artifact which runs at a constant angular velocity. The degree of sophistication (‘complicatedness’) remains unchanged over time and the mechanism may be studied with arbitrary detail. Predictions as to its behavior can be made with high precision.

In the case of the watch movement, as the sophistication of the mechanism increases, the external observer sees no difference – the system continues to be a deterministic artifact which runs at a constant angular velocity. The degree of sophistication (‘complicatedness’) remains unchanged over time and the mechanism may be studied with arbitrary detail. Predictions as to its behavior can be made with high precision.

Things change dramatically is the system in question is time-varying and if, for example, its properties change in a non-stationary fashion. Imagine that in the above case, the links between the various nodes disappear and reappear. Good examples are stocks, stock markets, portfolios, national economies, global economy, societies, ecosystems, human nature. These systems do not have static properties – there is no such thing. A system may be highly complex one day, only to become simple the day after. You cannot simply say that it is complex unless you actually measure its complexity and see how it evolves. As an example, think of an asset portfolio. Depending on how the market behaves, the portfolio can appear as risky or safe, volatile or stable. The same goes for complexity. Because it may change constantly, one cannot say that the system in question is complex or not. It depends.

Let’ talk about financial products and in particular let’s see an example of a trivial “static” classification according to their “complexity” (of course, the authors here meant “complicated”, not complex), only very few examples are reported:

“Simple” products:

Corporate Bond (Fixed Coupon), Mutual Funds (Gold funds, Plain equity funds), National Savings Certificates.

“Complex ” products:

Asset Backed Securities (Fixed Coupon – payment protected), Collateral Debt Obligations, Convertible Bonds, Debt Funds (floating rate), Mutual Funds (Derivative Funds)

“Highly Complex” products:

Corporate Bonds (Floating rate), Structured Bonds, Mortgage Backed Securities (with reset of yields), Real estate Investment Trusts (REIT), Equity Derivatives, Foreign exchange derivatives (Currency swaps), Credit Derivatives (Credit Default Swaps).

The idea of such classifications are, supposedly, to target better potential customers with the appropriate products (the sub-prime crisis immediately comes to mind). However, just because the calculation of the price of a product is not easy to understand for the non-expert, doesn’t mean that it is a complex product! The product may, at times, exhibit a behavior that is simple, only to become highly complex later. There are no simple or complex products. Because financial products interact with their respective markets, their dynamics is a mix of their intrinsic properties as well as of the instantaneous dynamics of those markets. This is why a product cannot be evaluated in a standalone manner – it has to be thrown into a market in order to appreciate fully its dynamics.

The bottom line is: if one wants to assess the complexity of a particular financial product, this must be evaluated on a time-varying basis and, most importantly, in conjunction with the evolution of the corresponding market(s).

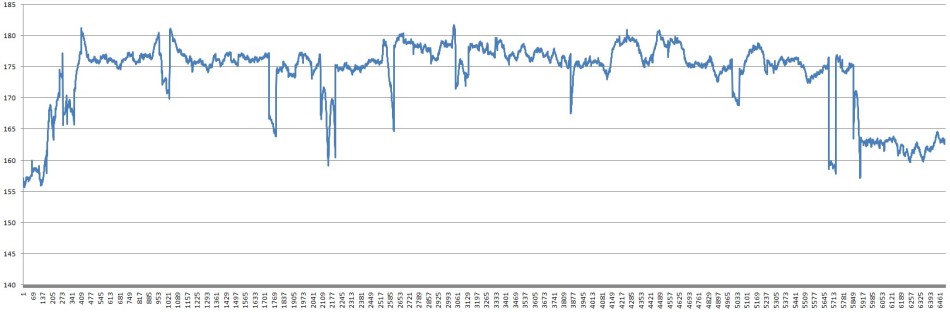

The following are examples of complexity evolution – C(t) – of various systems.

Complexity of a single stock from the S&P market ( a period of 300+ trading days is reported).

Complexity of an electroencephalogram (EEG). The monitoring period is 10 minutes.

Complexity of an electroencephalogram (EEG). The monitoring period is 10 minutes.

Complexity of electrograms (EGMs) recorded by pacemakers (the monitoring period is in the order of minutes). The increase in complexity precedes Ventricular Tachycardia.

Complexity of electrograms (EGMs) recorded by pacemakers (the monitoring period is in the order of minutes). The increase in complexity precedes Ventricular Tachycardia.

Complexity evolution of various financial products over periods of tens to hundreds of days. The variety of behaviors is immense – nonlinear dynamics in its purest form.

Complexity of the S&P 100 index in the period 2002-2011.

The above examples show why claiming that a system is simple (exhibits low complexity ) or complex (exhibits high complexity) is meaningless unless one specifies with which environment the system interacts and during which period of time. In order to understand better the complexity of financial products or markets, it is necessary to monitor it with an appropriate frequency and to identify the emerging patterns. During periods of low complexity, a given system is easier to grasp and control, during peaks of complexity things can get nasty. The only constant is change.

To see dynamic examples of stock portfolios click here.

Pingback: QCM and Distingushing AI-generated Fakes from Reality. – Artificial Intuition